October’s Newsletter

Len McCluskey, the dodgy telemarketer (and other implausible but true tales)

All in this month’s ‘compliance for customer people’ digest

Download it here:

September’s Newsletter

Philip Schofield’s shame and the £6,000 chocolate mystery

All this and more explained in this month’s newsletter. Honest!

Download it here:

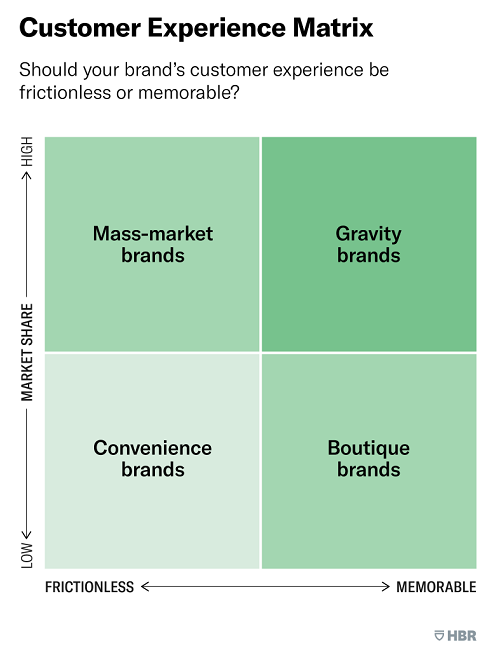

Customer Experience – Memorable or Frictionless?

What should you try to achieve with your customer experience? Should it be frictionless or memorable?

For most organisations having the chance to achieve either would be a fine thing, but if you’re on a journey it’s always best to have a destination in mind.

A recent Harvard Business Review article manages the deft trick of describing what we might dismiss as the blindingly obvious, but as I’ve never seen it laid out before, strikes me as actually quite enlightening.

Very simply put, the article finds that if you’re a mass-market, high transaction brand you should aspire to a frictionless experience, but if you are more of a niche player then memorable experiences should be your aim.

Whether there’s any causation between market share and style of #CX, or it’s the customer experience that influences growth is a different question, of course…

Here’s a link to the HBR article, which was written by Luke Williams, Alex Buoye, Timothy Keiningham, Ph.D. & Lerzan Aksoy.

July & August’s Newsletter

90 million reasons to check those letter texts…

A 10 minute catch up on all the sector & channel compliance news for customer people

Download it here:

June’s Monthly Newsletter

Fines piling up for pizza houses, politicians & lots more

Download it here:

Post-Covid Outsourcing: Diversify or Consolidate?

Thanks to the Contact Centre Panel for publishing

– my thoughts on whether at this time of massive change, brands which have outsourced their contact centre and customer management should be looking to consolidate or diversify?

Question Time: Complaints

I was lucky enough to join a really fascinating and wide-ranging Question Time discussion about Complaints organised by CallNorthWest and the South West Contact Centre Forum, last month.

You can catch-up by using the link here (just enter the Passcode pH@I0f49)

There were loads of insightful facts, techniques and perspectives from the lovely panel which included Katie May from Customer Management Resourcing, Mat Cornish of Avaya, Sally Greenaway of Premier CX and Virgin Media‘s Damien Morrissey.

CallNorthWest and SWCCF are organising these Question Time sessions every two months, so keep your eyes peeled for the next one in July!

Personalisation + Ownership = +28% Conversion

For years, lots of us involved in customer management have been convinced that nurturing personalised connections and relationships between customers and contact centre agents will deliver customer experience, engagement and revenue benefits, providing a positive business case for a more personalised approach. Now here’s a real-world example:

A contact centre operation which works with partners to handle enquiries and complete sales on their behalf has seen a 28% increase in conversion rates over the past year.

This improvement has come from starting to ensure that outbound call-backs are made by the same agent that handled the initial inbound query. In parallel the contact centre has introduced outbound ‘preview dialling’, which allows agents to check notes and prepare before each call. These changes in process mean that the personal connection made initially can be built on to increase engagement and reciprocation, helping outbound conversion rates from 18% to 23% – which far outweighs the decrease in simplistic, crude agent efficiency.

What’s the post-Covid operating model for contact centres?

A couple of weeks ago HGS‘ Graham Brown,Colleen McCann and Izzy Arlott described to me and the Contact Centre Panel team how they are already committing to a very different post-Covid operating model.

The new operating model has an on-trend name, HGS Work Cloud, but involves some significant, real-world changes, too. Moving to a new location in Chiswick, HGS’ new space is just one third of the size of the old one – but will also have less that one fifth of the seats.

So, when HGS’ staff – and its clients – are on-site they will have more space and better facilities, but they will do so on rotation, maybe one day per week. A very different way of working to how HGS delivered contact centre services before Spring 2020

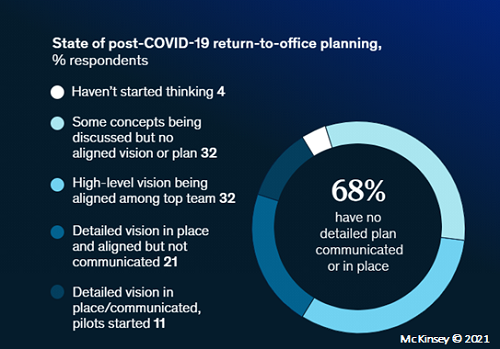

As McKinsey‘s research shows that over two-thirds of firms aren’t yet prepared for a post-Covid hybrid future, are HGS trail-blazing and seizing a first mover advantage?

What are other BPOs and outsourced customer management providers planning and doing post-Covid?

(When we posted this on LinkedIn we got some interesting answers to that question)

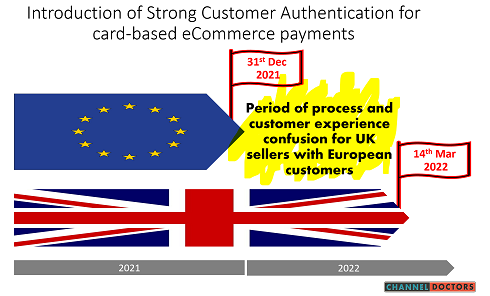

eComm confusion looms as SCA payments deadline slips

The Financial Conduct Authority has announced another delay – to 14th March 2022 – in the implementation of Strong Customer Authentication (SCA) for online card-based payments.

This may be good news and offer a bit more of a breathing space for UK eCommerce sellers, but not if they have customers in Europe. The EU’s SCA implementation date remains 31st December this year.

So, online vendors need to work out how to manage newly differentiated processes and customer experiences in a way that minimises revenue loss and customer defection from the 1st of January.

Need a hand? Give us a shout hello@channeldoctors.co.uk