So, we’re agreed…?

This week’s statistic is remarkable just because it’s shouldn’t be a surprise. For once it shows that brands and customers are thinking the same way about service and #customerexperience.

According to ContactBabel‘s typically detailed ‘The UK Customer Experience Decision-Makers’ Guide 2020-21’ report, not only do 53% of B2C organisations’ decision makers rank First Time Resolution as the most important of 8 factors for customers contacting them, but so do 57% of those customers too. In a world of excessive “inside out” thinking about customer service and a lack of attention to what customers actually want, this congruence is refreshing.

But it’s only a start.

Customer queries get more complex and their contact channels more varied all the time. To be able to understand and solve challenging questions – and better still, anticipate and negate them – needs a rare combination of data, insight, technology and old-fashioned empathy.

If you would like to talk through how to meet that challenge, just get in touch.

(and if you’d like to read the full report, it’s available from Steve Morrell of ContactBabel or its sponsor Enghouse Interactive)

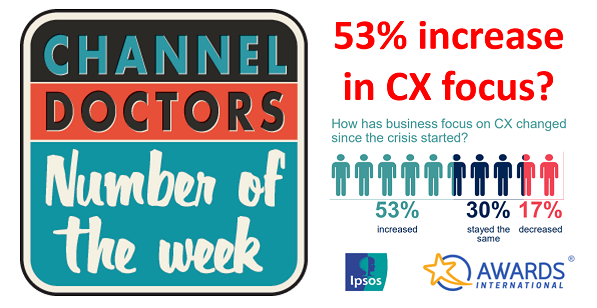

Where does optimism end and self-delusion start?

I don’t know and I don’t suppose you ever can be sure without the benefit of hindsight.

So, I was interested to see that 53% of the respondents to Ipsos CX & Awards International‘s ‘CX Voices: 2020’ survey said that since the start of #covıd19 their organisations’ focus on CX had increased.

It would be nice to think that in the face of unprecedented disruption and the deepest recession we have ever known that more than half of businesses were spending more energy focusing on #customerexperience, but I doubt it.

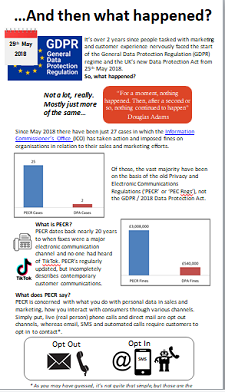

…And then what happened?

Remember the GDPR? Over 2 years on, we’ve done a quick bit of research into the Information Commissioner’s Office‘s sanctions and fines for sales and marketing. This has identified that in the ‘customer world’ it’s all about the old Privacy & Electronic Communications Regulations (PECR) rules. Learn about PECR and how it impacts your customer communications in this infographic:

July & August’s Monthly Compliance Newsletter

Stay Alert – Control Compliance – Save Fines!

This month’s headlines:

• Money Supermarket firm fined £90,000 for sending illegal marketing emails

• Privacy Shield goes the way of Safe Harbour and EU-US data transfers get a lot more tricky (which doesn’t bode well for Brexit Blighty)

• The ICO’s ‘GDPR era’ multi-million £ fines just get smaller and smaller…

• The Competition & Markets Authority sees no concerns as Amazon wades into the food delivery market (but highlights the dangers of middle aged men colluding in Wetherspoons)

• Shell’s loyalty scheme radio advertising banned for being insufficiently ‘carbon neutral’

• Dodgy ‘number look up’ site fined £1.1m for misleading consumers

Download it here:

June’s monthly compliance newsletter

Forget the GDPR, worry about PECR! What you really need to get right to avoid fines

This month’s headlines:

•Our research shows that 2 years on, it wasn’t the GDPR we should have been worried about, but PECR!

•Lloyds fined £64m by the FCA for not managing mortgage collections processes properly and fairly

•The Competition & Markets Authority tries to head off (another) digital advertising near-monopoly

•Ofcom advises consumers to avoid the Test & Trace scammers (who may be up & running before the government is) – and gives Vodafone some good news

•Energy suppliers can re-start debt collecting after a Covid pause – but to be nice, say Ofgem

•£1m fine for rip-off customer service number ‘look up’ sites

•Still not sure what you need to have in place for home-working? Here’s an article we wrote for the CCMA that should help

Download it here:

‘Gig CX’ – customer service saviour or threat?

20%-25% of customer service may be handled by ‘gig economy’ workers by 2025, according to Ember Group & Limitless Technology’s ‘The 2020 Gig Customer Service’ report.

There’s no doubt that ‘gig CX’ is attracting a lot of attention (like home-working used to until one day in early April when most people woke up to find out that they were doing it!)

The Report makes for interesting reading. It shows that ‘gig CX’ is being used by mainstream brands like National Express, Sage & Unilever. And it also describes the range of activities that ‘gig CX’ encompasses, from brand enthusiast crowd-sourced communities to far more transactional home-based, paid-by-the-query models.

The potential impact of the former can be massive. I’m a GiffGaff customer and customer service is almost wholly delivered by mobile telephony obsessives, happily and for for free. A win-win-win for customers, community members and brands.

However, the home based transactional model has potential reputational dangers for brands. ‘Gig working’ might mean freedom and flexibility to some, but is redolent of exploitation and financial insecurity to others.

There is a great onus on employing brands and service providers to be confident they are recruiting the empowered and not the insecure.

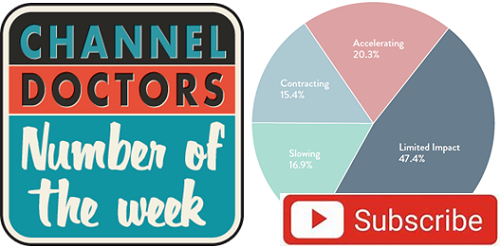

The rise of the subscription economy goes on & on

The subscription (or membership) economy continues to thrive through #Covid19, according to research from Zuora in this report.

Although there is – unsurprisingly – contraction in subscription volumes in some sectors such as travel, 85% of subscription bases continue to grow. 20% of them at a quicker rate than pre-Covid (and that growth can’t all be down to Netflix and Zoom).

This shows that the shift to a rent-not-own consumption model is resilient, but as the report explains that is increasingly reliant on flexible, responsive pricing and service models.

The subscription economy is dependent on genuine, data-driven #customerengagement

May’s monthly compliance newsletter

Tweets, Leaks, Tetris & Fines… who said compliance is boring? Read On!

This month’s headlines:

•How failing to respect Covid-19 social distancing rules can cost you your reputation and maybe your business

•EasyJet faces £18bn bill for data breach (claim giddy ‘no win, no fee lawyers)

•eCommerce firms cut more slack as Strong Customer Authentication payment rules are delayed (again)

•Big drop in nuisance calls, says Ofcom research

•Vodafone generate twice the broadband industry average level of customer complaints, EE & Sky less than half

•Lord Sugar’s cheeky advertising tweet turns sour

•Travel and flight refund disputes drive surge in consumers’ C19 complaints

•CMA blocks merger to ensure creps* price competition

•Scam tech support firm fined £500,000 for illegally calling consumers

*me neither, but I looked it up

Download it here:

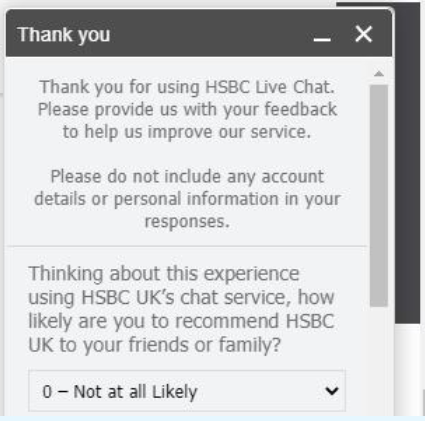

HSBC’s NPS Nonsense

The thing is, HSBC, that even in these trying times I haven’t yet sunk to recommending banks’ chat services to my friends and family. Has anyone ever done that?

Surely this isn’t what Fred Reichheld & Satmetrix had in mind?

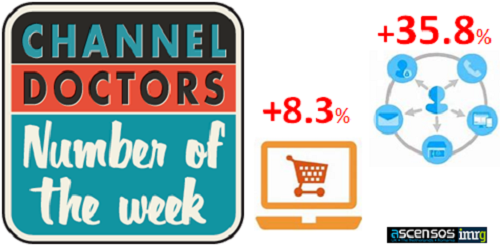

Omnichannel outperforms pure-play ecommerce x4

Omnichannel retailers are outperforming their ‘pure play’ eCommerce rivals fourfold in online sales growth.

Ascensos‘ William Carson highlighted this is an article for The Retail Bulletin drawing on IMRG research into April’s UK online sales figures.

William’s article (https://lnkd.in/dqFNNX4) explores just why this might be, but it points to the vital contributions experience and relationship make to driving online revenues.