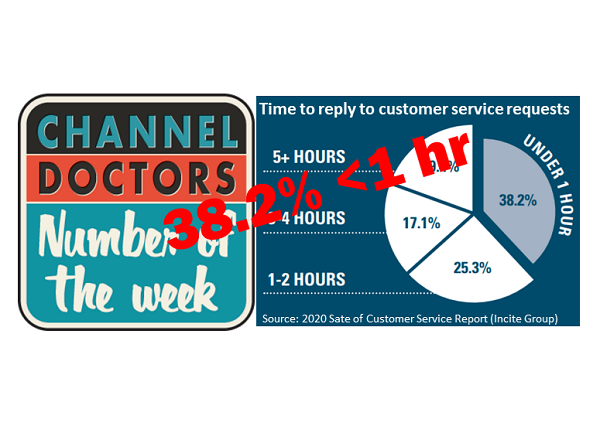

38.2% < 1 hour

A recent survey of nearly 1,000 customer service professionals globally by Incite Group (‘2020 State of Customer Service’) found that 38.2% claimed to reply to customer service requests within one hour.

On the face of it, this is an impressive stat; only a few years ago very few organisations would reply to customer requests within the day (and in fairness, many still struggle to do so).

However, the same research found that over 30% of organisations hadn’t yet even started to offer social customer service. In a world where social is the channel of choice for growing numbers of consumers this perhaps casts the first finding in a slightly different light. Are customer service professionals who strive for excellent response times on communication channels which are becoming less meaningful, while not embracing new channels, running the risk of just “building a faster horse”, to quote Henry Ford?

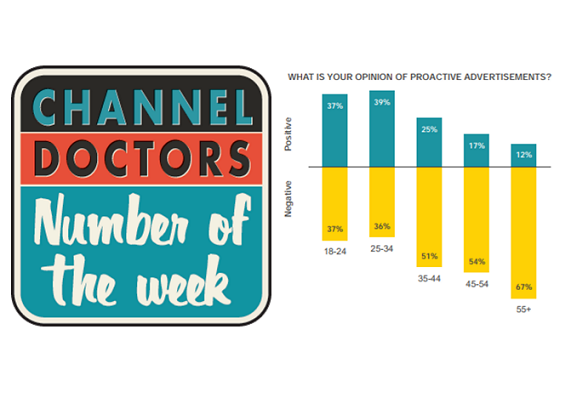

35+

Marketers love personalised advertising and consumers don’t? That seems to be one of the take-aways from Concentrix‘s recent ‘Uncovering Digital Trends’ research.

Certainly, over the age of 35 it seems that consumers increasingly regard personalised advertising more negatively than positively.

So, brands firstly need to steer clear of ‘uncanny valley’, seeming to know too much about consumers and getting ‘creepy’. Instead they need to focus on appropriately utilising the data and insights they do have on customers and prospects – very often the data that’s shared face-to-face and in contact centre conversations, but isn’t captured to customers’ and brands’ mutual advantage

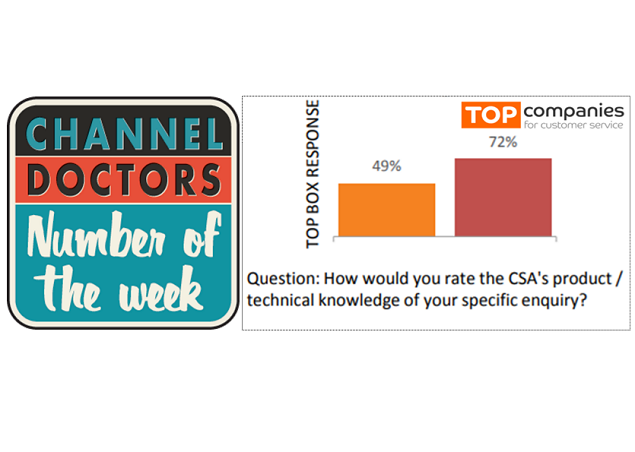

49%

According to the Top Companies for Customer Service‘s ‘Baseline Benchmarking Report 2018′ less than half of social media customer service agents’ knowledge was considered to be Excellent. The research was conducted by GfK and assessed scores of major brands (and found that the ‘Top 50’ group members performed significantly better)- but is ‘Excellent’ product knowledge too big an ask?

I don’t think so.

No brand has ever been forced to deliver customer service over social channels; it’s a choice. Social is a very public world and it’s users are often emotionally engaged and short of time and/or patience. Brands SHOULD be the experts in their products and services! If their customer service teams aren’t then they should maybe stop trying to provide customer service on social. See what we think – and watch the video at www.channeldoctors.co.uk/cx

+12% £

Businesses which maintain accurate, relevant data enjoy 12% higher revenues and 40% better results from targeted marketing campaigns than their less organised peers.

This National Audit Office (NAO) finding was cited by 9 Group‘s Paul Buckle at Osborne Clarke‘s ‘GDPR…One Year On’ event in Bristol on Tuesday. Paul explained how data like this helped him form the value and business case for GDPR/DPA 2018 compliance – making good data management a business driver, not a drag on progress.

May’s Monthly Compliance Newsletter

Channel Doctors’ May Compliance Newsletter, with all the regulation and compliance news for customer-focused professionals.

May’s Headlines:

- Nintendo, Xbox & PlayStation’s customer retention techniques under scrutiny

- The CMA blocks the Sainsbury’s-Asda merger

- Bounty fined £400k for pre-GDPR data protection abuses

- Pensions firm fined £40k despite getting advice from specialist consultants and lawyers

- Funeral plan firm fined for calling TPS numbers

- Data cleanse leaves TPS file numbers 4m down vs 2018

Download your copy here:

or subscribe for free and receive the Newsletter in your inbox every month http://eepurl.com/gqxzw5

2000 ways to ask

2,000 is this week’s Number of the Week.

“A bank in Australia came across almost 2,000 different ways for how people could ask for a bank balance. These were all programmed into their chatbot. You would think this query would be straightforward, but it takes time!”

David Naylor of Humanotics quoted in Call Centre Helper, this week.

I read that after a fascinating afternoon at Sitel‘s Newcastle contact centre discussing the Future of Customer Engagement with their guests, on Thursday. One of the themes that emerged was about the potential of new technologies, like bots, to improve customers’ experience – but only if implemented with thought and care. Just like the man says.

46%

This week’s number is from a conversation I had with Ultracomm‘s Bev Hughes, yesterday.

Their speech analytics exercise for a massive leisure and travel brand demonstrated that 46% of its conversations with customers were comprised of silence or ‘dead air’.

Irrespective of the underlying reasons – which are no doubt busily being investigated – that indicates an awful customer experience. And without the new, machine learning technology-driven abilities to undertake ‘free form’ analysis of speech, text and dialogue patterns – what we’re calling Speech Analytics 2.0 – the client may never have even realised…

7%

When rational call routing becomes a negative customer experience.

One of many fascinating findings in Ultracomm’s “It’s Still Good to Talk” research is this: 34% of callers to UK contact centres face more than one set of options to navigate – which must directly contribute to the 7% of callers who gave up on their call.

Technologies like IVRs which allow contact centres to better understand the nature of the calls they are receiving and/or route them to the right agents can be very useful, but anything that stands between a consumer and the person they want to talk to should be treated with great caution. “Press or say 1 for this and 2 for that…” can cause customers’ hearts to sink and the 7% who subsequently give up trying to speak to your people are unlikely to stick with you much longer

April’s Regulation & Compliance Update from the DMA’s Contact Centre Council

Each month Channel Doctors’ Steve Sullivan prepares a summary of all the news contact centre and customer experience professionals need on regulation and compliance for the Direct Marketing Association (www.dma.org.uk)’s Contact Centre Council.

April’s headlines include:

Bounty fined £400k for pre-GDPR data protection abuses

Pensions firm fined £40k despite getting advice from specialist consultants and lawyers

Funeral plan firm fined for calling TPS numbers

Data cleanse leaves TPS file numbers 4m down vs 2018

Download the Update here:

+47%

47% increase in remote or card not present fraud – that is, when a criminal uses stolen card details to buy something on the internet, over the phone or through mail order – is a startling statistic in UK Finance’s ‘Fraud: The Facts 2019’ report.

A stark reminder of the financial losses that can be experienced through self-service and contact centre channels, as well as the practical need for organisations ensure they’re PCI DSS compliant, especially in light of the PCI’s revised guidance on taking phone payments.